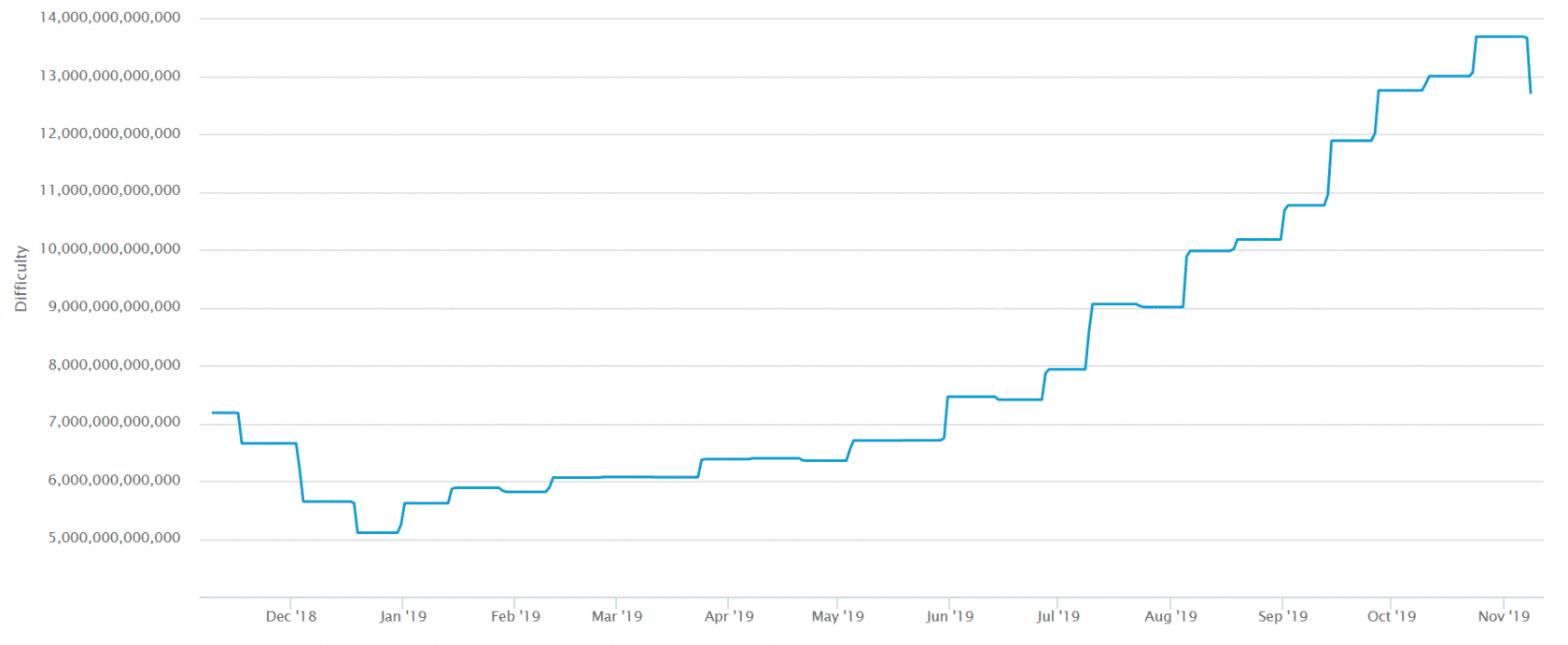

According to blockchain.com statistics, the Bitcoin mining difficulty index fell 7% on November 8. For almost 1 year, except for slight declines, it has continued to rise, so this is the first time it had gone down since December 19, 2018, when it fell 9.5%.

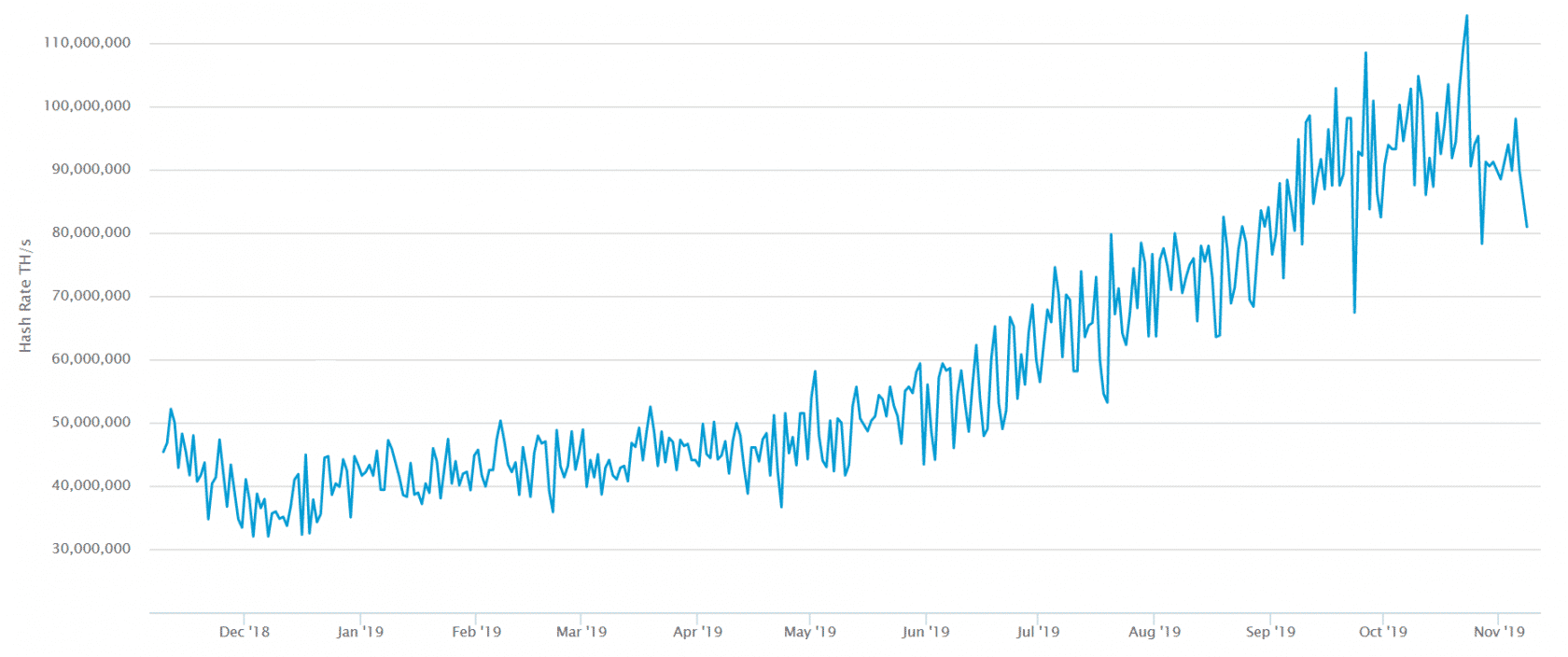

After the hash rate plummeted momentarily on September 23, it remained unstable after that. As the hash rate dropped significantly at the end of October, it was only a matter of time before it was reflected in the mining difficulty. However, the hash rate has almost tripled over the past year. Even it slightly dropped, it is not safe from the viewpoint of the impact on the global environment of power consumption. We’ve also heard that Jihan Wu has been reinstated at Bitmain to push for IPO in New York Stock Exchange. If the current bitcoin price continues, there could be another significant investment in mining business.

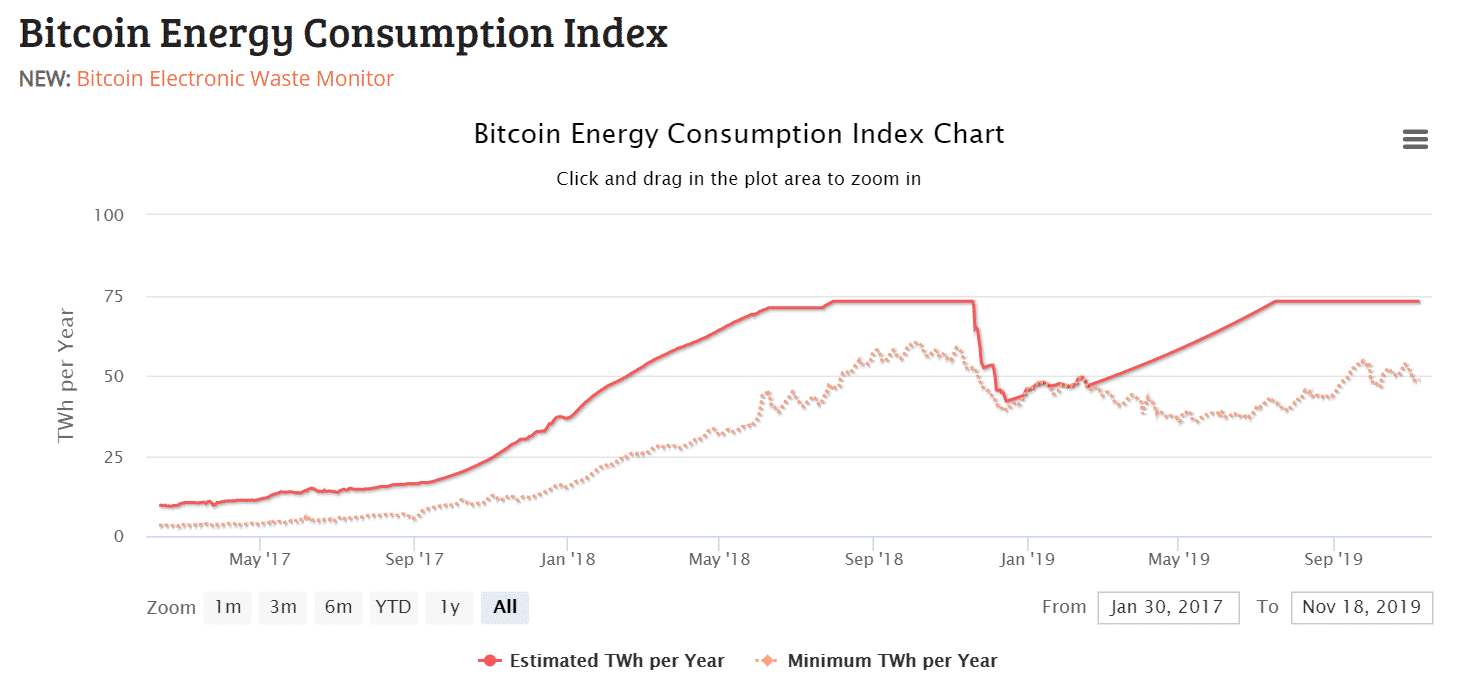

There are several estimates of the environmental impact of such mining operations. The most notable is the digiconomist.net Bitcoin Energy Consumption Index, which hasn’t been updated since it raised its estimate to 73 TWh/year in July.

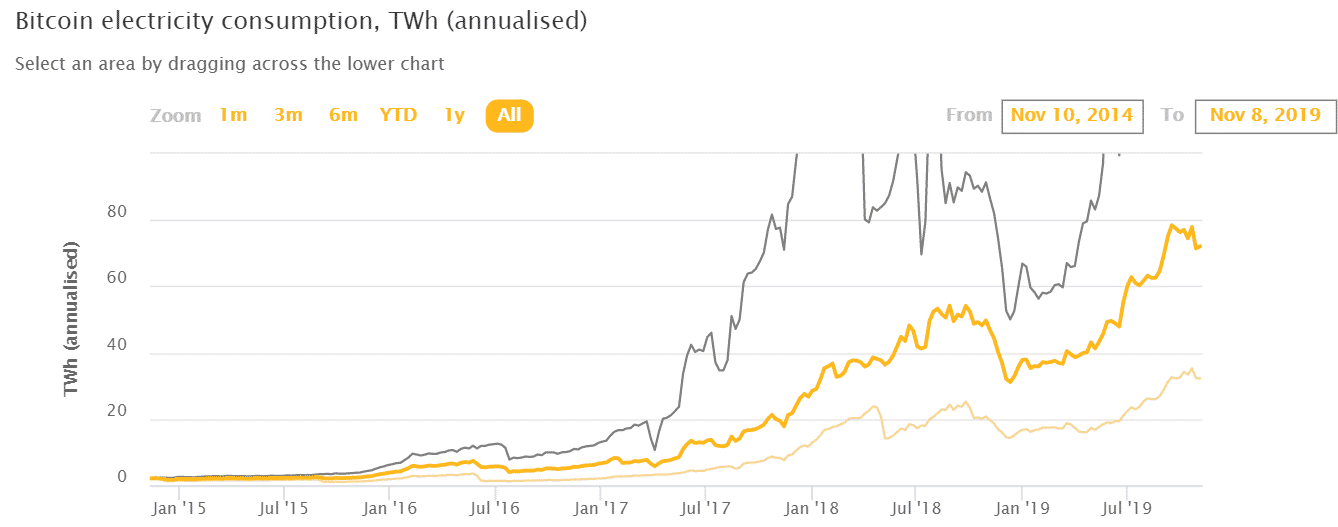

Another estimate, the Cambridge Bitcoin Electricity Consumption Index on cbeci.org, is an honest reflection of recent hashing rate trends. That’s about 72 TWh/year.

Energy consumption does not increase in proportion to the increase in hash rate and difficulty of mining because of the energy efficiency improvement of mining machines. However, it is not sustainable from the viewpoint of the global environment that the Bitcoin mining business, which is already consuming as much electricity as Austria, will continue to expand. Given that reality, I don’t think it’s rational to expect bitcoin to exist in the distant future and continue to trade at prices higher than it is today.